https://www.realestate.com.au/property-apartment-vic-sandringham-128416666 Live inside-out high above it all with al fresco entertaining, 5 Star resort facilities and...Read More→

For those who like to watch the property market closely, the market segment that recorded the largest drop was new apartments, where building approvals fell 17.2 per cent in August. This represented a year-on-year drop of 23.4 per cent when compared with August 2017. The ABS reported that approvals for standalone houses showed a gentler drop of 1.9 per cent in August and 4.4 per cent year-on-year.

Whilst any fall in building approvals is never good news for the overall economy, this trend is particularly concerning when you consider the rate that our population is growing, as we pointed out in OUR POST LAST MONTH.

Interestingly, an analysis of this data by economists at the ANZ Bank has revealed that unlike past falls in housing approvals, this latest drop has been driven by a tightening of the credit market rather than the usual lifting of interest rates.

If this proves to be the case, then we see this trend continuing for some time to come. A Senior Economist at the ANZ has been quoted as saying, “If we assume no easing of the credit tightening until at least after the royal commission delivers its final report in February 2019, then it seems reasonable to expect that dwelling approvals could be off as much as 15–20 per cent in trend terms by early next year.”

In the longer term, it is worth remembering that any fall in residential construction will cause an even lower level of supply of housing in a market where demand continues to grow as a result of an increasing population…Concerns about the affordability of housing look likely to continue.

If you have questions about how your own local property market is been performing, or you are wondering how to maximise the price you achieve when you sell in the current market, don’t hesitate to give Floris Antonides a call on 0418 504 915. You can also get a FREE copy of our booklet, Fatal Real Estate Traps Exposed, while you’re here on our website.

Should they buy their next property first, then sell their existing home, or vice versa? The fact is that there is no straightforward answer that will suit every person, as the answer will depend very much on your own personal circumstances and preferences. But, having said that, here’s an outline of the relative pros and cons of each option so you can make your own informed decision.

As a general guide, we tend to find that in a ‘normal’ property market most people prefer to sell their existing home first, then purchase their next home afterwards. This approach gives you some certainty as to how much your current property is worth, and therefore what your budget will be for the next property. It also gives you certainty on the timing of the settlement for your current home so that you can aim to move just once.

The downside to this approach is that if you have difficulty finding and securing your next home, you may end up having to find temporary accommodation in between settlements, which will mean making two moves rather than one.

This approach was certainly more popular in recent years, due mainly to the strength of buyer demand. With more buyers than sellers, many people knew they would be able to sell their current property with relative ease…but securing their next home was more of a challenge!

However, buying before you sell in the current market conditions can be more financially complex, particularly if you do not have access to the full purchase price of your new home without relying on the proceeds of the sale of your existing home.

Buying first may mean that you find yourself under extra pressure to sell your existing property by a set date, meaning you may be under pressure to accept a lesser offer than you would like. In this situation you may also need bridging finance, which can be a more expensive form of loan than your standard home loan.

One option if you are considering buying first is to make your purchase conditional on the sale of your existing home. However, in many cases the sellers of your new home may not wish to accept a conditional offer, so it will put you at a disadvantage in any negotiations.

Clearly, if your peace of mind is an important element to your decision, you may prefer to sell your existing home first. But as we all know, it’s hard to predict when we might stumble across the ‘dream home’ that we simply “have to buy”.

Don’t forget that if you are at all unsure about the right way to proceed when planning a move, we are always happy to provide you with sound advice and assistance, and our service won’t cost a cent more than having to deal direct with an agent.

You can call Floris Antonides anytime on 0418 504 915.

While we are not in the business of providing advice on home loans, it is a topic that does crop up when advising senior home owners on their property dealings.

With this in mind, we wanted remind readers that whilst a reverse mortgage can be a helpful form of financing for retirees who are “asset rich but cash poor”, the recent Royal Commission into the financial industry has reminded many Australians of some of the shortcomings of this form of home loan.

A reverse mortgage is a type of mortgage loan that is specifically designed for pensioners and retirees. Sometimes referred to as a senior’s loan, a reverse mortgage enables homeowners aged over 60 to convert the equity in their property into cash. The loan is secured by a mortgage over the borrower’s house and whilst interest is charged just as with any other form of loan, you don’t have to make repayments while you live in your home. Instead, the interest compounds over time and is added to your loan balance. Repayment of the loan only occurs when you sell your home, you move to an aged care home or you pass away, but you are usually allowed to make voluntary repayments if you wish.

Since September 2012, laws have been in place to protect anyone with a reverse mortgage from owing the lender more than the property is worth…a situation known as negative equity. However, this is still a concern if you took out a reverse mortgage prior to that date.

Generally speaking, the main issues with taking out a reverse mortgage today are:

Clearly, there are several reasons to tread carefully where a reverse mortgage is concerned.

As we all know, a number of financial products have come under review as the Royal Commission continues to examine recent lending practise. Indeed, the Australian Securities and Investments Commission (ASIC) has suggested that lending standards on reverse mortgages have not always been fair for elderly borrowers.

ASIC has said that borrowers do not have sufficient understanding of the risks and future costs of their loans, along with the impact on their ability to fund their needs in the future. The Deputy Chairman of ASIC, Peter Kell, has been quoted as saying that while reverse mortgage products can help many people entering retirement achieve a better quality of life, there is still a need for a thorough risk analysis.

In our experience, it is always wise to seek independent advice on any financial decision, whether it affects your home or not. Of course, if you do have questions about selling your home, you’ll find lots of tips in our FREE book, Fatal Real Estate Traps Exposed, or you can call the Floris Antonides any time on 0418 504 915.

Indeed, many astute property market observers say that one of the key contributors to the growth in property values in Melbourne over the past few years has been the rate of population growth across our city. So we thought this would be a good opportunity to take a look at some recent figures on population growth and how they might impact on the Melbourne property market in the future.

As many readers will already be aware, Melbourne is now officially ranked by the Australian Bureau of Statistics as the capital city with the fastest population growth in the country. The most recent figures say that in 2016-2017 our city recorded its highest ever net annual population growth, increasing of 125,400. This was a growth rate of 2.7 per cent.

Based on figures like these, leading demographer Bernard Salt has predicted that Melbourne’s population will pass five million by 2021 and exceed eight million by 2050. Mr Salt has also forecast that Melbourne could pass Sydney as Australia’s biggest capital city by 2030.

Obviously, this level of population growth will mean that we need more housing to accommodate more residents. In fact, a report by the Victorian state government last year forecast that we will need 1.6 million new homes over the next 35 years to cover this growth.

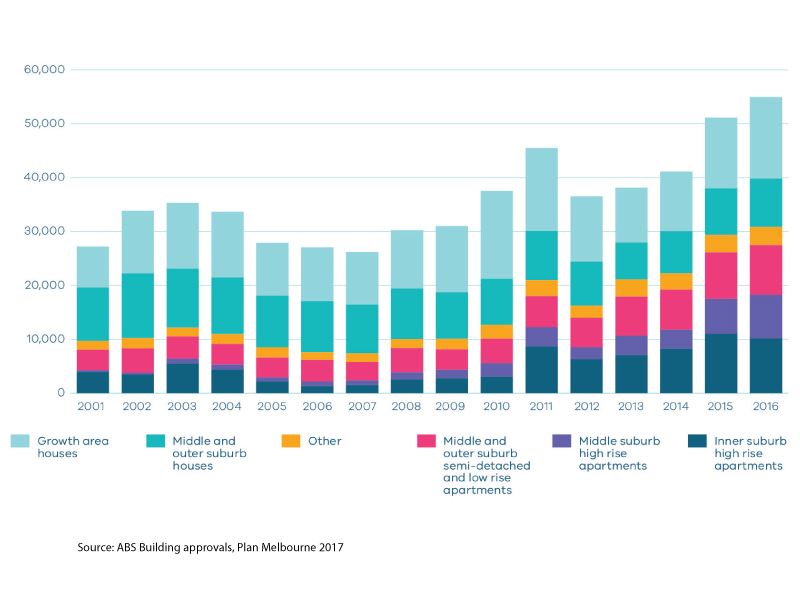

This forecast would mean an average of just over 45,700 new homes per year, and that’s a problem. As the graph above shows, Victorian construction data so far this century shows that we have only reached that number of new building approvals three times in the past sixteen years!

As we touched on above, a sustained increase in demand for housing driven by population growth combined with a lack of supply of suitable new dwellings for families is likely to produce strong long-term growth in house prices…just as Melbourne has experienced in recent years.

It’s a sobering thought for those who may have thought that the recent media stories about a drop in Melbourne’s property values were the start of a long-term slide!

Remember, if you need any help in setting out a long-term plan for your own property dealings, you can give one of the team at Ian Reid Vendor Advocates a call on 9430 0000. Or, if you are simply looking for ways to avoid making expensive mistakes when you sell your home, you’ll find lots of tips in our FREE book, Fatal Real Estate Traps Exposed.

However, this is actually an oversimplification of the true state of affairs, as our experience has shown that there are some misunderstandings about the overall Spring market, just as there are different markets depending on when in Spring you sell.

One clear misunderstanding is that whilst the Spring market is an active time for anyone buying or selling property, the increased activity is not as marked as many people believe. Recent figures from Corelogic showed that the number of properties on the market increases by around 10% during Spring. However, a 10-year study conducted earlier this decade found that the busiest season for property sales nationally, (as opposed to property listings), is actually Autumn. What’s more, the difference in sales from the busiest season to the quietest is also far less dramatic than most people would assume.

One thing that history has taught us here at Ian Reid Vendor Advocates is that whilst the spike in property listings during Spring does encourage more buyers to the market, it can also mean that competition between sellers can increase as well. This tends to be more apparent later in Spring, when the number of sellers increases due to the influence of successful purchasers who then need to sell to complete their purchase. The later you leave it to place your property on the market, the more likely you are to face a market with more sellers, and less buyers because a percentage of these have already purchased.

In contrast, the earlier in Spring that you put your property on the market, the lower the level of competition from other vendors, and the larger the pool of potential buyers that are available to inspect your property.

Another factor that makes selling earlier in the Spring market is the increased opportunity to plan your settlement prior to the Christmas break, the time frame preferred by many families. By moving home before the end of the year, families are able to settle into their new home at their leisure and avoid many of the hold-ups that a property settlement in January, (when many businesses are closed), can experience.

Remember, if you need any advice or assistance in making the most of this year’s Spring market, other than those you’ll find in our FREE book, Fatal Real Estate Traps Exposed, you can call on Floris Antonides at any time on 0418 504 915.

However, one move that really caught our eye came from one of the regional lenders. Heritage Bank, which is based in country Queensland but has branches across Australia, has unveiled a new service which should appeal to quite a few buyers…they are offering an expedited home loan approval system which can provide loan approvals within as little as 24 hours in some circumstances!

Known as the ‘Fast Track’ option, this new approval process requires borrowers to submit their application through an independent Mortgage Broker, and to provide all the correct documentation at the time of applying. Apparently, the bank has been testing the concept for several months and approved more than 10% of the total applications received from brokers within the 24-hour period, with the fastest approval taking only an hour and a half!

It is worth noting that in order for a borrower to use the Fast Track system, their application must be a fairly straight forward one. This includes being an Australian resident and citizen, having held the one job for more than a year, requiring a loan of less than 80% of the value of the property, and having a clean credit history.

Whilst rapid loan approvals may not be of interest to every borrower, the willingness of the Banks to try new ideas to attract new business certainly seems like a positive trend for most borrowers. We will watch with interest.

In the meantime, if you are thinking about housing finance as part of a plan to sell and move in the future, don’t forget to read through our FREE booklet, Fatal Real Estate Traps Exposed. You’ll find lots of tips on ways to avoid several expensive mistakes when selling.